Everyday Americans everywhere are receiving random text messages from unknown senders. The content of these messages sometimes makes it apparent that they are scam messages, but often it not.

Engaging with these senders is a slippery slope since typically these messages are meant to entice the recipient into sending money or making an investment in a sketchy scheme.

Pig Butchering Scams

According to a Wall Street Journal investigative report, billions of dollars are lost every year due to these scams. Some refer to this as pig-butchering because the scam starts with compliments and friendship before the scammers “butchers” them by tricking them into giving away their money. The term comes from a Chinese saying that describes the fattening of the pig before slaughtering.

Statistics show that the scams are now a multibillion-dollar industry built on the backs of something horrific, slave labor. What most people are unaware of is that the people sending these messages are also victims, lured by what they believed was a high paying job and entrapped into a life of slavery.

These scams have multiple victims. The scammer is often also a victim entrapped in a life of slavery, forced to work for ruthless operators in slum conditions.

Pig Butchering Operations TTPs

Pig Butcher scammers operate using a network of accounts over many different social media, messaging and dating platforms that include:

- Text

- Telegram

- TikTok

- X (formerly Twitter)

- Tinder

- Bumble

- Hinge

The Phases of the Scam

The term Pig-Butchering is a term associated with a Chinese saying where farmers feed pigs to fatten them before slaughtering them. Scammers use the same premise, tricking their victims to invest big bucks into a non-existent scheme.

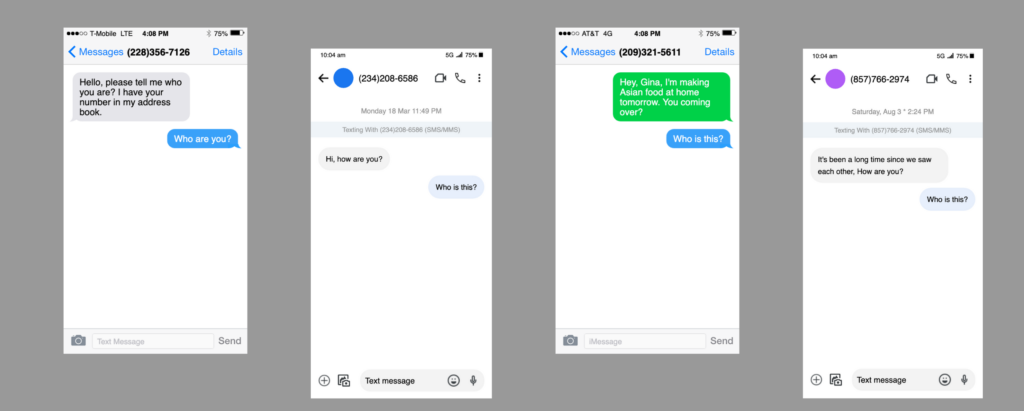

Phase 1: The Initial Contact

Typically, the scam will start with a text message from an unfamiliar number. There are a few scenarios they present to lure the victim into a conversation. They claim to be a harmless stranger or a long-lost friend; sometimes they claim to have your number but are not sure who you are and are trying to match the number.

Phase 2: Trust Building

Once the scammer thinks you’ve friended them, they become friendlier, they complement the victim, and frequently will start a flirtation with them. The nature of the messages and conversations lure the victim into trusting the scammer.

Phase 3: The Love Fest

The scammer works to build more trust by sharing photos, showering the victim with sweet affection messages and related.

Phase 4: The Butchering

Once the initial communication is successful, the conversation is “herded” to another messaging platform. The Butcherer builds trust with the Pig by flattery, romantic conversations, sharing photos, and more.

What Happened at Heartland Tri-State Bank: The Crypto Scam

The story of Heartland Tri-State Bank gives testimony and truly shows how an employee is the weakest link when it comes to cybersecurity. Shan Hanes was duped in a scam where he transferred millions, including embezzled funds, to scammers to fund a crypto investment over a span of 8 years. He became the pig, in a well-documented case that resulted in shareholders losing their savings and the bank closing its doors.

What can seem like an innocent text message can result in something much more sinister and a loss to businesses of billions of dollars. Some studies suggest that the losses from these Pig-Butchering scams can be $75 Billion globally or more.

Companies should provide training to help employees know the warning signs of these scams.

Text Scam Warning Signs

These scams rely heavily on social engineering. It’s a long game plan focused on earning the trust of victims. These warning signs seen by anyone should be a signal to cut the scammer loose.

- “Wrong number” texts and WhatsApp messages

- A new online acquaintance begins discussing crypto and investing schemes siting “guaranteed returns”, although no interest was shown

- Getting “love bombed” by a new match on a dating site

- Scammers use emotional manipulation as a tool to gain trust.

- Being requested to download an app for crypto trading or investing

- The scammer offers a tutorial trading session, to show how it works

- Quick, small returns on initial investments

- Tells the victim that to withdraw returns there’s additional fees or taxes owed.

Suspect a Scammer Is Targeting You? Here’s What to Do.

Once you’ve responded to a message, the scammer will continue in their attempts. There are a few techniques to get off their radar and prevent any further activities.

- Break off all contact on every platform. Don’t attempt to explain it or say goodbye. Doing so would only put them on alert.

- Report and block their account or accounts. These groups typically seek to use several digital friends of the host, as these add to their credibility. Do this for every profile that may be a part of their scam operation.

- Change all passwords and credentials for logins. New accounts will be needed if account numbers or access codes for crypto accounts, wallets or any were shared.

- File a report with the FBI’s Crime Complaint Center (IC3). Including specific details and supporting documents from your interaction with the scammer helps. For example, share screenshots of emails, texts and WhatsApp messages.

- File a report with the police. Inform the local police with all details about the fraud. Also ask them to contact the crypto exchange.

Set up monitoring on all your online and financial accounts and remain vigilant for any sign of fraud. Watch credit reports and credit card accounts for transactions that seem unusual.

Emerging TTPs

As these scams continue to evolve, the operators are adapting and refining their strategies. New tactics, including some that help them target and manipulate their victims more effectively, are being observed.

New trends show a move to using group chats, which let the scammers gain a wider pool of potential targets and identify their victims more rapidly.

The New Workflow

Scammers are now adding multiple targets to investment chat groups to locate targets more efficiently.

- This technique helps the scammers learn which potential victims to target. If one of them shows an interest in investing, the conversation is moved to a private one-on-one chat.

- At this point, they introduce the target to a fake brokerage firm where they a suggested to transfer funds to its website.

This workflow is repeated as these scammers continue to search for more targets for the scheme. Adding multiple people to these chatgroups focused on investment discussions simplifies the process of measuring the interest of the intended victims.

Impacts of the Scams

Recently, the FBI released a report on pig-butchering scams. The financial impacts are devasting. Thousands of people have fallen prey to these scams. The result shows millions of US dollars being lost.

Many experts believe that the numbers are much higher since some victims may not have reported.

Who Are the Victims

The demographics of the victims stand out. Based on the amounts paid into the scammers account, experts believe the targets are not victims with limited savings. These scams seem to target demographics that are more established, which include high-salaried professionals and those nearing retirement.

According to the IC3 report, victim losses have reached approximately US$3.31 billion. This amount includes complaints related to cryptocurrency investment fraud.

With it being likely the scammers are casting their nets for the “big fish,” experts say it’s now critical to raise awareness and be proactive in taking action against these scammers.